News

Business Survival Tips for COVID-19

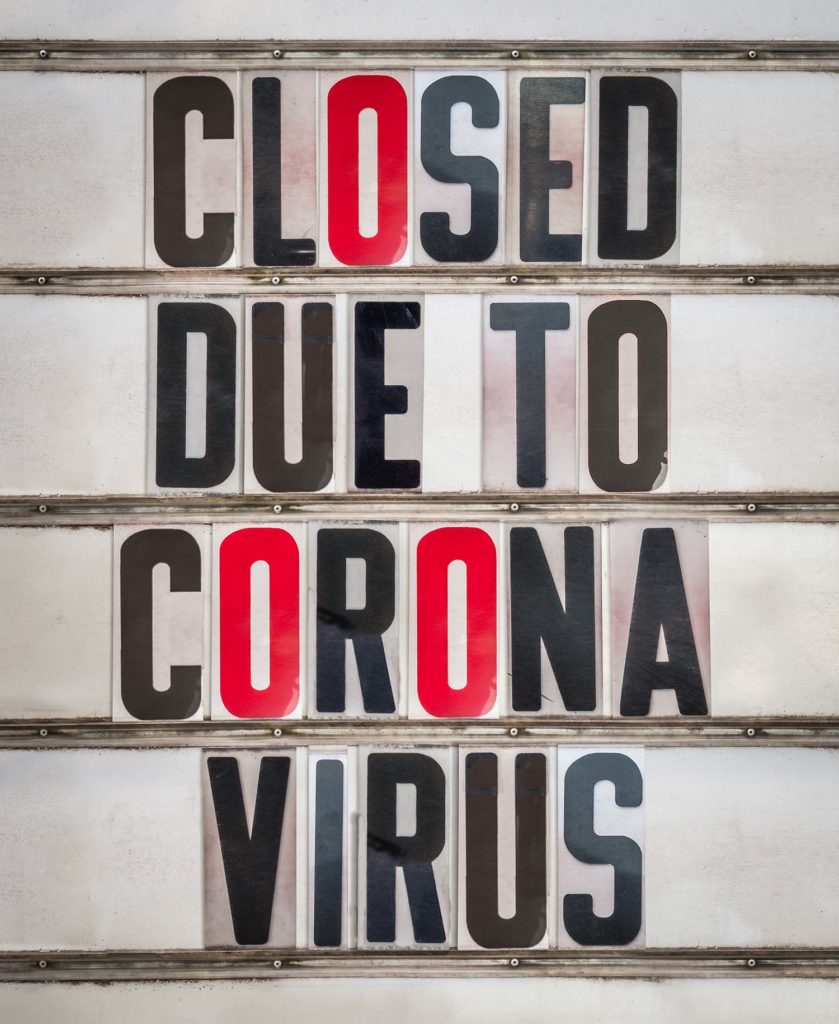

Your restaurant, store, medical practice or virtually any other business is shut down by governmental restrictions related to the COVID-19 pandemic. What do you do? How can your business survive? Your landlord is demanding payment. Your vendors shipped product that you now cannot use but they are demanding payment. You are forced to consider all options to survive, but what options do you have? Bankruptcy is an option, but is it the only option? No. The federal government is currently considering relief for businesses and employees, but the final configuration of that relief is unknown, and you need options now. With no revenue, you need to reduce or abate your ongoing business expenses until you can resume your normal business operations. You have contracts, employee obligations, rent and other recurring commitments that remain despite COVID-19 and related government restrictions.

Your restaurant, store, medical practice or virtually any other business is shut down by governmental restrictions related to the COVID-19 pandemic. What do you do? How can your business survive? Your landlord is demanding payment. Your vendors shipped product that you now cannot use but they are demanding payment. You are forced to consider all options to survive, but what options do you have? Bankruptcy is an option, but is it the only option? No. The federal government is currently considering relief for businesses and employees, but the final configuration of that relief is unknown, and you need options now. With no revenue, you need to reduce or abate your ongoing business expenses until you can resume your normal business operations. You have contracts, employee obligations, rent and other recurring commitments that remain despite COVID-19 and related government restrictions.

Because COVID-19 is an unprecedented, unforeseen pandemic that has shuttered businesses around the world, you may have legal grounds to stop meeting those commitments that you would pay except for the virtual shut down of your business. Under these current pandemic conditions, the purpose of the contracts and commitments that you made may be frustrated or performance of your obligations may be impossible. Florida and other jurisdictions may allow a contracting party to stop performing when the purpose of a contract is frustrated unforeseen events or “acts of God” that neither contracting party caused. You certainly did not cause the COVID-19 pandemic and certainly when you entered into your current contracts, you did not foresee the pandemic or the effect it would have on businesses in the United States and around the world. As an example, if you ordered equipment for your restaurant that you now cannot use due to these unforeseen conditions or you hired a new nurse to assist with elective procedures that you no longer may perform, the law may consider the entire purpose of those contracts frustrated. If so, the law may relieve you of your contractual obligations. The determination of frustration of purpose is factually intensive, and any decision to cease performing is not without risk that a Court will decide that the temporary shutdown did not frustrate a contract’s purpose. You, however, may have no choice. You may need to cease performing because you do not have revenue to pay and your business cannot survive unless you get an abatement or modification of your obligations. The frustration of purpose or “acts of God” claims, if nothing else, are certainly strong arguments on which to negotiate an abatement or modification of your commitments. We have a team of lawyers with bankruptcy and contract negotiation experience to assist in modifying or abating your commitments based on frustration of purpose, “acts of God” or through bankruptcy, if required.

If your business has commercial lines insurance, your policy also may have coverage for some of your losses. You should you review your policies for any applicable coverage. Commercial policies will often have business interruption or contingent business interruption insurance coverage. While those coverages often require actual physical damage to your premises or have specific exclusions for losses caused by a virus, it is important to review your specific policy. If there is any doubt about whether your losses are covered, it does not hurt to submit a claim. To submit a claim, you will need proof of your losses. You will need historical financial documents to establish your track record of profits. You should also track any extraordinary expenses caused by the COVID-19 pandemic and governmental restrictions. Those expenses, if documented adequately, should be excluded from the calculation of your profits. If your losses are caused by a third-party that cannot pay because of the COVID-19 pandemic, you should maintain documentation from the third-party establishing the inability to pay.

Your policy may also provide coverage for extra expenses that you incur because of the COVID-19 pandemic. You must keep detailed records of those losses and, if possible, how the pandemic directly caused those additional expenses. If, for instance, you incurred expenses for cleaning caused by a suspected COVID-19 exposure, you should have the vendor note on the invoice that cleaning was related to a COVID-19 exposure. There are many variations of these issues and we remain ready to assist you with a review of your policies, contract negotiations or advice on insurance claims.